The State of Media and Entertainment Streaming Video

YouView will deliver straightforward VOD opportunities for content suppliers such as LOVEFiLM (which has existing distribution with Samsung and PS3) and aggregators such as blinkbox, as well as digital services from Skype, YouTube, or Facebook. A YouView application software development kit (SDK) should provide a way for content owners and brands, hitherto priced out of digital TV platforms, to gain access to the living room. This could mean anything from linking interactivity directly to a linear show to offering red-button-style access to HD or behind-the-scenes content or mashups of video with blogs.

There’s money behind it too. Samsung has a £100,000 pot to attract developers to its platform, saying it wants people to think “beyond providing VOD,” and Channel 4 has set aside £1.9 million to finance connected TV content, assigning a new commissioner of convergent formats to manage it.

Developers will need to keep an eye on how quickly platforms achieve significant market penetration. FutureSource estimates that the total U.K. IP-enabled TV installed base will be 5.6 million in 2011, growing to 28 million or 100% household penetration by 2014. YouView predicts figures of 3 million–4 million installs of its devices by 2014.

Connectivity is becoming standard in consumer electronics products. Stakeholders as diverse as managed service providers, content aggregators, and third-party application developers will play a role in how these devices link to services and allow the consumer to discover new ways to interact with entertainment.

Parks Associates indicates the number of European households with a connected TV will grow to 47 million in 2014. The number of households with a connected Blu-ray player will jump from 5 million in 2010 to approximately 66 million over the same period.

T-Commerce

While it won’t scale for some time, ecommerce via internet connected devices—notably the TV—will loom large on agendas in 2011.

Last year, following a short trial, BSkyB launched its addressable ad offering, AdSmart, around on-demand service Sky Player. This will act as a blueprint for integration on Sky’s satellite platform in 2011, marking the debut of mass-market targeted advertising on linear TV in the U.K. As with HD and 3D, BSkyB in the U.K. tends to pioneer new technologies for other members of the News Corp.-owned group Sky Deutschland and Sky Italia to follow.

Although addressability is seen in some quarters as the salvation of spot advertising, it has to overcome a number of impediments. These include measurement, scale, and the transformation of entrenched media-buying attitudes and skill sets. Virgin Media is also testing VOD advertising (pre-, post- and midrolls) across its national base with a subset of content providers as a prelude to commercial launch. It is not currently testing targeted ads, but this is on its timetable.

Sky+HD boxes will receive select advertising downloaded and stored to the hard drive. When triggered, these new ads will be substituted for those in the linear stream. As with Sky Player, all Sky TV subscribers will be offered a chance to opt out.

Sky’s Olive database pools up to 150 points of customer information to target ads, ranging from its already comprehensive knowledge of subscribers (postcodes, subs packages) with publically available data (electorial rolls, National Suppression Files) and acquired market research. It is explicitly not tracking the browsing or VOD habits of its customers to avoid the privacy concerns that bedevilled BT Group’s trials with Phorm in 2009.

Marketers may be wary about investing in a platform that lacks the scale of a national TV buy, especially if different platforms offer competing technologies. This problem has beset attempts in the U.S., where cable-industry-backed Canoe Ventures put its ad targeting project onto ice in 2009, although the project is being revived for 2011.

YouView’s stakeholders will let content providers decide on how they manage the payment mechanisms on the connected TV platform. “YouView is not for profit; it’s not going to own content; it’s not going to sell content for itself. So for us it doesn’t seem appropriate that it then controls the payment gateway,” explained CEO Richard Halton.

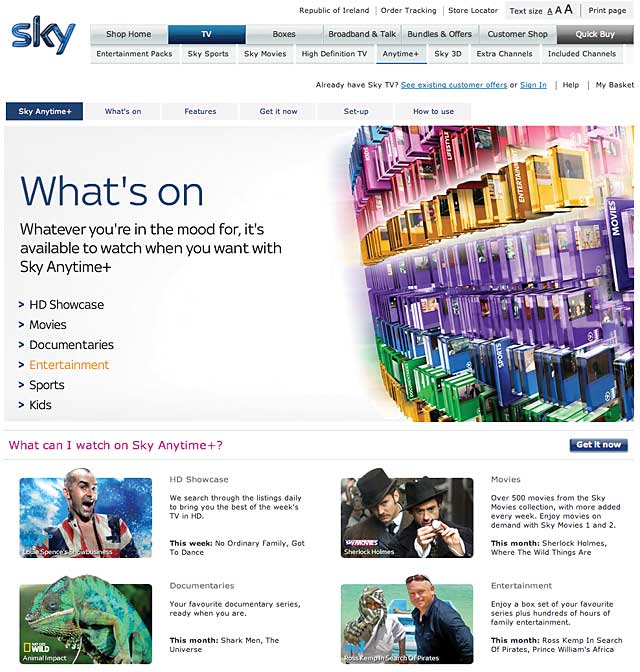

U.K. services such as Sky Anytime+ are paving the way for similar offerings from other members of News Corp.-owned groups such as Sky Deutschland and Sky Italia.

Related Articles

Netflix and Amazon sit atop the cord-cutting throne. Do Disney, Apple, or any other challengers have what it takes to compete?

09 Mar 2018

Using social networks or shopping during linear broadcasts helps viewers feel like they're part of the conversation.

14 Feb 2012

While Netflix has swept across the U.S, it will struggle for profitability in the U.K, says CEO.

29 Jul 2011

The supermarket giant moves into the video on-demand space, following in the footsteps of Amazon and Walmart.

21 Apr 2011

More connected television and set-top box viewers will be able to see Lovefilm's instant library.

15 Mar 2011